Let’s break down what mining actually is and how it works, as well as what is needed to mine or extract Bitcoin coins.

On October 31, 2008, a programmer under the pseudonym Satoshi Nakamoto published a document titled "Bitcoin: A Peer-to-Peer Electronic Cash System" – the Bitcoin whitepaper.

On October 31, 2008, a programmer under the pseudonym Satoshi Nakamoto published a document titled "Bitcoin: A Peer-to-Peer Electronic Cash System" – the Bitcoin whitepaper.

On January 3, 2009, the very first Bitcoin block was mined. This date marked the birth of cryptocurrency – money that does not have a centralized authority.

- Bitcoin mining in simple terms is the process of creating new blocks in the first cryptocurrency network, based on solving complex mathematical problems by computers. One of the translations of the word "mining" is "extraction of natural resources."

- he reward for mining is new bitcoins. Mining is the only way to issue the first cryptocurrency.

- Bitcoin mining involves individuals and organizations (miners) who perform calculations using specialized devices, thus creating new blocks. In return for this work, miners receive rewards from the network – new coins.

- In addition to Bitcoin, mining is also used in other cryptocurrency networks that operate on the Proof-of-Work algorithm. However, the mining equipment used may vary across these networks.

Bitcoin Mining: Process Explanation

Each transaction on the Bitcoin network is confirmed and recorded in a block, which is then added to a unified "chain." The essence of mining is to "find" or "extract" a new Bitcoin block through resource-intensive computations. These computations are carried out simultaneously by multiple miners using specialized equipment.

Thus, mining serves several functions: verifying transactions in the Bitcoin blockchain, creating blocks, and issuing new bitcoins. When extracting a new block, miners compete against each other.

Mining is an integral part of the architecture of any blockchain that operates on the Proof-of-Work (PoW) consensus algorithm. The mining process involves calculating the hash (output data) of the block header in the blockchain. A single block includes:

- The hash of the previous block’s header

- The hash of the transactions

- A random number

When forming a new block, the miner receives a reward – a certain number of bitcoins. The higher the total computational power of the equipment being used, the greater the likelihood of mining a new block and, consequently, receiving a reward.

Typically, the transactions included in a block are considered confirmed after six consecutive blocks have been calculated.

How much is paid for a new bitcoin block and what does halving mean?

The reward for a new block in the Bitcoin network is fixed and, as of 2024, is 3.125 BTC. However, since the launch of the first cryptocurrency’s blockchain, this reward halves every 4 years.

The reward is reduced by half every 210,000 blocks, which occurs approximately every four years. A total of 32 halvings are planned in Bitcoin’s protocol, after which the creation of new coins will no longer be possible.

Halving is a deflationary mechanism built into the protocol of the first cryptocurrency by its creator, Satoshi Nakamoto. The purpose of halving is to prevent a drop in the price of Bitcoin due to an increase in the number of coins available in circulation.

When the Bitcoin network was launched in early 2009, the reward for a block was 50 BTC. Following the first halving in 2012, the reward was reduced to 25 BTC, in the summer of 2016, it dropped to 12.5 BTC, in the summer of 2020 it was reduced further to 6.25 BTC, and on April 20, 2024, it will decrease to 3.125 BTC. The next halving will occur in 2028.

In 2012, when the first halving took place, the future creator of Ethereum, Vitalik Buterin, explained its significance by comparing Bitcoin to "digital gold."

"The supply of the precious metal (gold) in the world is limited, and with each gram, it becomes increasingly difficult to extract. The limited supply of gold has been influencing its value in international trade and accumulation for over 6,000 years. I hope Bitcoin will do the same."

What do hashrate and network difficulty mean for Bitcoin mining?

Hashrate or hashing speed characterizes the total computational power of the network, meaning all the mining equipment that is active at the moment. Hashrate is one of the key indicators, as it directly affects the final profit of Bitcoin miners.

Network difficulty is the value of computational power required to mine a new block, which the protocol automatically adjusts based on the hashrate. The difficulty indicator is necessary to maintain a stable block production time (about 10 minutes). It can change depending on the hashrate, either increasing or decreasing.

Thus, hashrate indicates how many computational operations per second the mining equipment can perform. As the power of the Bitcoin network increases, the difficulty of mining blocks also increases, and this is adjusted every 2016 blocks, or roughly every two weeks.

To measure the computational power of equipment, the unit H/s (hashes per second) is used. For example, as of December 4, 2024, the network's hashrate was 712 EH/s.

Is Bitcoin mining profitable?

The economic profitability of mining the first cryptocurrency is determined by several key factors: electricity costs, equipment performance, calculation difficulty, and the market price of the digital asset.

Equipment is one of the fundamental components for the existence of the first cryptocurrency. When the Bitcoin network was first launched in 2009, mining was done using CPUs on home computers. The very first genesis block was mined by the creator of the first cryptocurrency, Satoshi Nakamoto.

Over time, mining equipment evolved, and new technologies attracted more and more enthusiasts. CPU mining was fully replaced by graphics cards (GPU), which offered higher computational performance.

One of the first pieces of publicly available mining software for graphics cards was released by a BitcoinTalk forum user named Puddinpop.

By 2012, many miners were already assembling mining farms—systems connecting multiple graphics cards. That same year, the first ASIC (Application-Specific Integrated Circuit) machine was released, a device specifically designed for Bitcoin mining, and which is widely used today.

What is an ASIC, how much does it cost, and how does it help in Bitcoin mining?

The computational resources required for hashing blocks greatly exceed the power of any supercomputer. As a result, modern mining uses expensive specialized devices and chips, the production of which has become a multi-million-dollar industry in itself.

An ASIC (Application-Specific Integrated Circuit) is a specialized microchip designed for mining a specific digital currency. ASICs provide significant computational power but require considerable investment.

What are mining pools?

Today, there are two types of mining: individual and collective, meaning solo mining or participation in a mining pool.

Individual mining refers to mining cryptocurrency alone (solo mining) using personal equipment, where the miner receives the entire reward for the block.

A mining pool is a group of miners who combine their computational power, increasing the chances of finding a block. The reward is then distributed among all the participants.

Typically, to ensure productive cooperation, mining pools appoint special coordinators. They are responsible for overseeing all organizational matters and managing the distribution of rewards. The reward is divided according to calculations based on the amount of work done by each participant.

There are two main payout models: Full-Pay-Per-Share (PPS) and Pay-Per-Last-N-Shares (PPLNS). The key difference is that in the PPS model, participants receive rewards for the block plus transaction fees, while in PPLNS, they only receive the block reward.

According to BTC.com, as of December 2024, the largest Bitcoin mining pools are Foundry USA, AntPool, F2Pool, and Binance Pool, which together account for two-thirds of the network’s hashrate.

How much do Bitcoin miners earn?

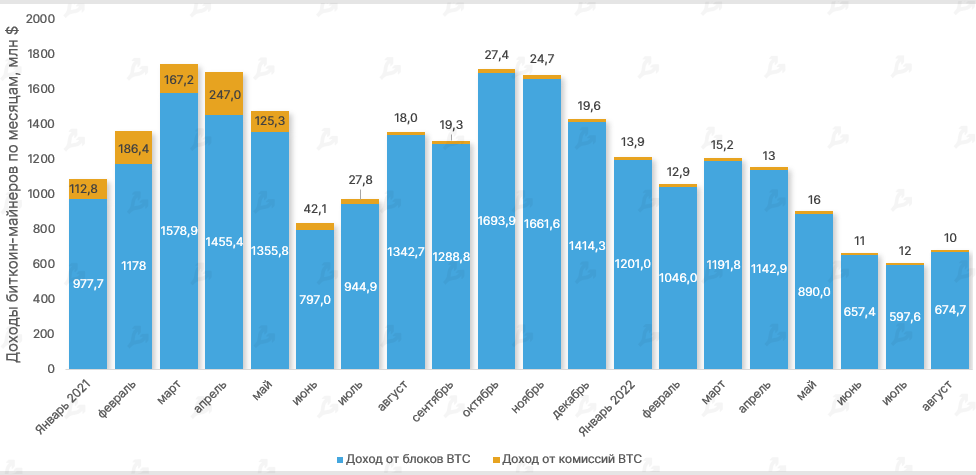

Bitcoin miners earn hundreds of millions of dollars monthly. For example, in August 2022, they earned a total of over $684 million. Throughout 2021 and early 2022, this figure often exceeded $1 billion.

Bitcoin miners' monthly income from January 2021 to August 2022. Data: ForkLog

Global Bitcoin miners' daily income ranges from $25 to $35 million.

Until the end of 2020, Bitcoin miners earned no more than $25 million per day. However, from October 2023 to April 2024, their income increased significantly, reaching a peak of nearly $108 million per day on April 20, 2024.

Here are the days when miners earned the most from Bitcoin:

| Date | Income of Bitcoin miners, $ |

|

2021 (Jan. 7) |

45.50 mln. |

|

2021 (Mar. 4) |

58.76 mln. |

|

2021 (Apr. 15) |

80.17 mln. |

|

2021 (Nov. 11) |

65.18 mln. |

|

2023 (Dec. 21) |

59.08 mln. |

|

2024 (Mar. 7) |

78.50 mln. |

|

2024 (Apr. 20) |

107.76 mln. |

*The article was written using materials from the following websites: forklog.com,inclient.ru,ycharts.com